Gold has been a symbol of wealth and security for centuries, and in recent years, it has gained popularity as an investment vehicle for retirement savings. A Gold Retirement Account, often referred to as a Gold IRA (Individual Retirement Account), allows individuals to invest in physical gold and other precious metals as part of their retirement portfolio. This report aims to provide a comprehensive overview of Gold Retirement Accounts, including their benefits, types, and considerations for potential investors.

What is a Gold Retirement Account?

A Gold Retirement Account is a self-directed IRA that allows individuals to hold physical gold, silver, platinum, and palladium in their retirement savings. Unlike traditional IRAs that typically invest in stocks, bonds, and mutual funds, Gold IRAs provide an alternative investment option that can act as a hedge against inflation and economic uncertainty. The Internal Revenue Service (IRS) regulates these accounts, ensuring that they meet specific guidelines for tax advantages.

Types of Gold Retirement Accounts

- Traditional Gold IRA: This type of account allows individuals to invest pre-tax dollars into physical gold. Contributions may be tax-deductible, and taxes are paid upon withdrawal during retirement.

- Roth Gold IRA: In contrast to a Traditional Gold IRA, contributions to a Roth Gold IRA are made with after-tax dollars. While contributions are not tax-deductible, qualified withdrawals during retirement are tax-free.

- SEP Gold IRA: A Simplified Employee Pension (SEP) Gold IRA is designed for self-employed individuals or small business owners. It allows for higher contribution limits than traditional IRAs, making it an attractive option for those looking to save more for retirement.

- Simple Gold IRA: This is another option for small businesses, allowing employees to contribute to a Gold IRA with lower administrative costs and simpler requirements.

Benefits of Gold Retirement Accounts

- Diversification: Including gold in a retirement portfolio provides diversification, as gold often behaves differently than stocks and bonds. This can help reduce overall portfolio risk.

- Inflation Hedge: Gold is often seen as a hedge against inflation. When the value of fiat currency decreases, gold typically retains its value, making it a reliable store of wealth.

- Tangible Asset: Unlike stocks or bonds, gold is a physical asset that can be held in hand. This tangibility can provide peace of mind for investors who prefer to have a physical representation of their wealth.

- Tax Advantages: Gold Retirement Accounts offer the same tax benefits as traditional IRAs, including tax-deferred growth or tax-free withdrawals, depending on the type of account.

- Potential for Appreciation: Historically, gold has appreciated in value over time, making it an attractive long-term investment. Economic instability often drives up gold prices, providing potential for significant returns.

Considerations for Investing in Gold Retirement Accounts

- Custodians and Storage: Gold IRAs require a custodian to manage the account and ensure compliance with IRS regulations. Additionally, physical gold must be stored in an approved facility, which incurs storage fees. It is essential to choose a reputable custodian with experience in managing Gold IRAs.

- Costs and Fees: Investors should be aware of the various costs associated with Gold IRAs, including setup fees, storage fees, and transaction fees. These costs can impact overall returns, so it is crucial to understand the fee structure before investing.

- Liquidity: While gold is a highly liquid asset, selling physical gold can be more complicated compared to selling stocks or bonds. Investors should consider their liquidity needs and the potential challenges of converting gold to cash.

- Market Volatility: Gold prices can be volatile, influenced by various factors such as geopolitical events, economic data, and changes in interest rates. If you have any concerns regarding where and how to use trusted retirement investment in gold iras, you can get hold of us at our own web site. Investors should be prepared for price fluctuations and consider their investment horizon.

- IRS Regulations: The IRS has specific rules regarding the types of gold and other precious metals that can be held in a gold ira investment for wealth security IRA. Only IRS-approved bullion and coins are eligible, which can limit investment options.

How to Set Up a Gold Retirement Account

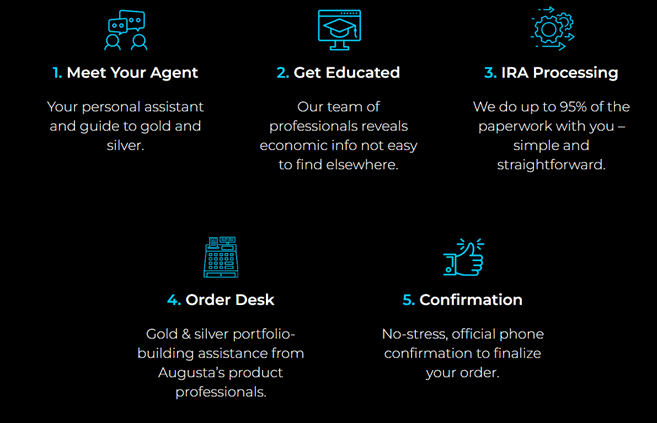

Setting up a Gold Retirement Account involves several steps:

- Choose a Custodian: Research and select a reputable custodian that specializes in Gold IRAs. Ensure they are IRS-approved and have a good track record.

- Open the Account: Complete the necessary paperwork to open a self-directed IRA. This may involve transferring funds from an existing retirement account or making new contributions.

- Fund the Account: Fund the Gold IRA through a direct transfer, rollover from another retirement account, or new contributions.

- Select Precious Metals: Work with the custodian to choose the types of gold and other precious metals to include in the account. Ensure that the selected metals meet IRS requirements.

- Storage Arrangements: Arrange for the physical storage of the gold in an approved depository. The custodian will typically assist with this process.

- Monitor Investments: Regularly review the performance of the Gold IRA and make adjustments as necessary to align with retirement goals.

Conclusion

A Gold Retirement Account can be an excellent addition to a diversified retirement portfolio, offering unique benefits such as protection against inflation and the potential for long-term appreciation. However, it is essential for investors to carefully consider the associated costs, market volatility, and IRS regulations before investing. By understanding the intricacies of Gold IRAs and working with reputable custodians, individuals can effectively incorporate gold into their retirement strategy, securing their financial future in an increasingly uncertain economic landscape.